Additionally, utilities such as electricity, water, and gas are recurring expenses that need to be monitored closely. If you feel the urge to buy something that isn’t in your spending plan, try the 30-day rule. Mark down the item and where you saw it and the price in your calendar for 30 days in the future. When that date arrives, if you still feel you must have it, you can find a way to buy it.

- This includes daily essentials, like your rent or mortgage payment, personal loans and insurance premiums.

- Gyms can adapt by offering special promotions during slow periods and diversifying services to attract and retain members year-round.

- Consider long-term contracts or bulk purchasing agreements to lower material costs.

- From running a successful gym to managing finances, gym owners have to navigate through a range of expenses to ensure their business thrives.

- This influences which products we write about and where and how the product appears on a page.

- She graduated from the University of Texas at Austin with a bachelor’s degree in journalism, and has worked in the newsrooms of KUT and the Austin Chronicle.

Innovations and additional revenue streams

This section explores what gym owners can generally expect in terms of monthly income and examines the key factors that play a pivotal role in determining their financial success. Once you have calculated your total fixed and variable costs, you can use this information to determine your break-even point. The break-even point is the point at which your revenue and costs are equal. This can be calculated by dividing the total fixed costs by the difference between the price of a membership and the variable cost per membership (also called contribution margin).

- Allocating resources to staff training and certifications is also essential to ensure they have the necessary skills and knowledge to provide top-notch service to the gym’s members.

- This requires you to be mindful of your spending, so you can stay within budget.

- In lean months, their fixed component remains stable, but employee incentives fluctuate with sales performance.

- Knowing how to include both in a budget is important to avoid overspending.

- This situation often arises when gyms offer prepaid plans or receive advance payments from members.

- At Keeper, we’re on a mission to help people overcome the complexity of taxes.

- How you approach saving money can vary, based on whether you’re trying to cut your fixed or variable expenses.

How to Calculate and Interpret Profit Margins in Gym Financial Statements

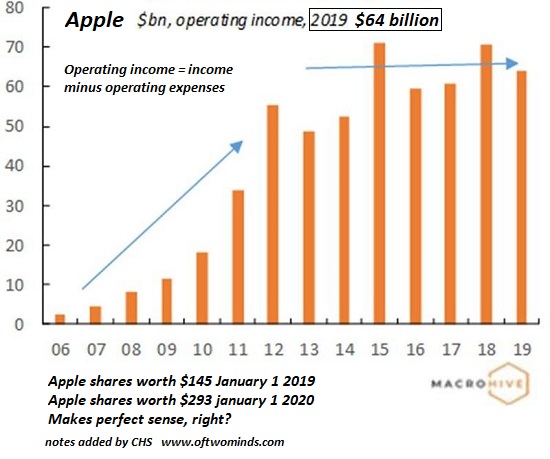

Digital fitness platforms have created a competitive environment, compelling traditional gyms to innovate and offer hybrid models combining in-person and online experiences. This shift has challenged gyms to diversify and enhance their services to maintain profitability. Factors such as operational costs, the gym’s scale, membership dynamics, and specific services offered play crucial roles in shaping these margins. The income of a gym owner in the U.S. is not a static figure; it fluctuates based on several variables. The average annual profitability range of $80,000 to $180,000 provides a baseline for potential income.

How do I start a small gym business?

It’s important to note that the P&L forecast is based on certain assumptions and predictions, and it’s not always accurate. File-sharing software, CRM programs, bookkeeping tools like Keeper, and even the entire Office 365 package! If you use apps like Renpho to track your clients’ body composition stats, include those here as well. Even if you can’t write off your gym expenses, there are plenty https://www.bookstime.com/ of other creative write-offs to think about. The IRS allows people to include weight loss activities in their itemized medical expenses, if their physician prescribes it following a diagnosis like obesity, hypertension, or heart disease. According to the 2017 IHRSA Profile of Success, the median profit margin for all clubs is 16.5%, 20% for fitness-only clubs, and 15.5% for multipurpose clubs.

- For personal budgeting purposes, fixed expenses are the costs that you can forecast with confidence because they don’t change from month to month or period to period.

- Gym owners are constantly seeking ways to reduce expenses without compromising the quality of their services.

- Gym management software or time clock systems can be leveraged to streamline this process, facilitating reliable data collection.

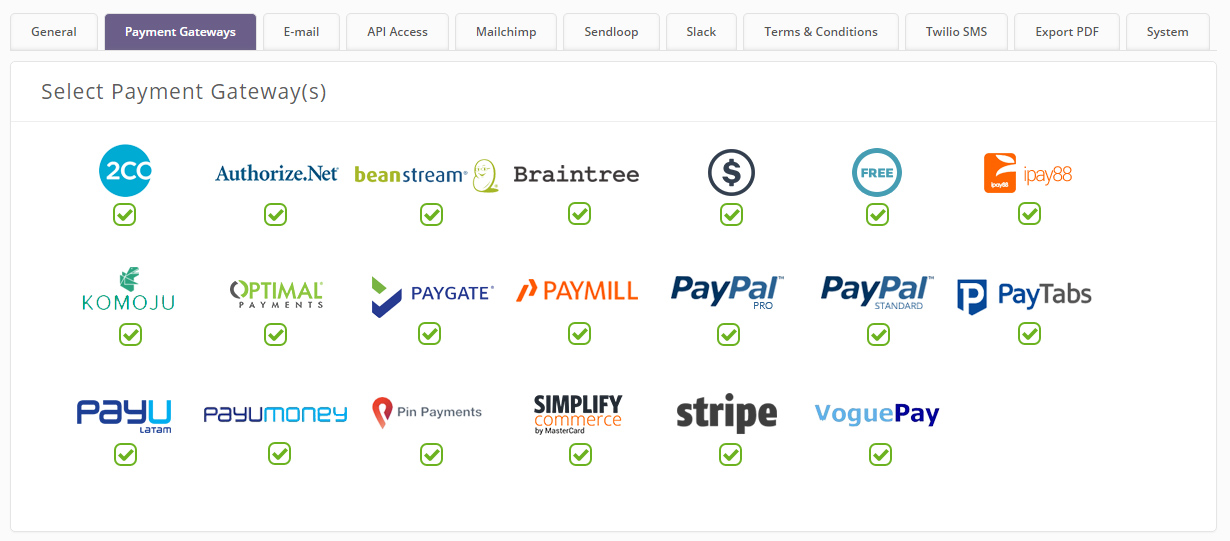

- Depending on your location, you may need to collect sales tax on certain goods and services sold, like merchandise or personal training services.

- To create a P&L forecast, you will need to gather information about your projected revenue streams, costs and expenses.

- ZipRecruiter says that the annual average salary of a gym owner in the US is $69,794.

If you opt to set aside the same amount of money for short-term savings and another chunk for retirement monthly, you’ll put yourself in a financially secure position. Though this isn’t a requirement, it’s wise to always pay your bills first before you pay yourself. Understanding the difference between the role that Gym Bookkeeping fixed and variable expenses play in your life can help you create a budget that prevents you from overspending. It can also help you prepare for other monthly expenditures, such as debt repayment or saving for future expenses. The amount you spend each time may vary, but you’re not paying for those expenses monthly.

What role does gym accounting software play in managing a gym’s finances?

- Average Revenue Per Member (ARM) is your total income divided by your total number of members.

- By accounting for all miscellaneous expenses, gym owners can ensure they maintain a well-equipped and smoothly functioning gym without any unexpected financial surprises.

- Another way gym owners can make extra income is by selling fitness and activewear products online or on-site.

- Proper accounting practices include accurately tracking and reporting employee contributions while ensuring that payroll deductions align with established guidelines.

- These figures suggest that while starting a gym in these states might be slightly more affordable than in California, it still requires a significant investment.