Moreover, clients can easily access their account history, pending orders and balance operations, eliminating the need to log in separately to the trading terminal. You can obtain insightful reports about partners and trading activities at your desired frequency, helping you to keep abreast of crucial business events. Your staff also has access to an array of charts and dashboards, offering graphical representations of data that can aid in strategic decision making.

In this respect, preparing a checklist to compare different solutions on the market before proceeding is necessary. By doing this, you can sort out what is required for your brokerage and note any issues that may currently be of concern such as website traffic or unhappy clients. All these aspects should essentially determine what features your Forex CRM should include. It is also important to customise your CRM in accordance with your clients’ needs. Finally, it is necessary to ensure that the Forex CRM solution you opt for should come with automation features.

Forex CRM. How to find the Best Solution for FX brokerage management

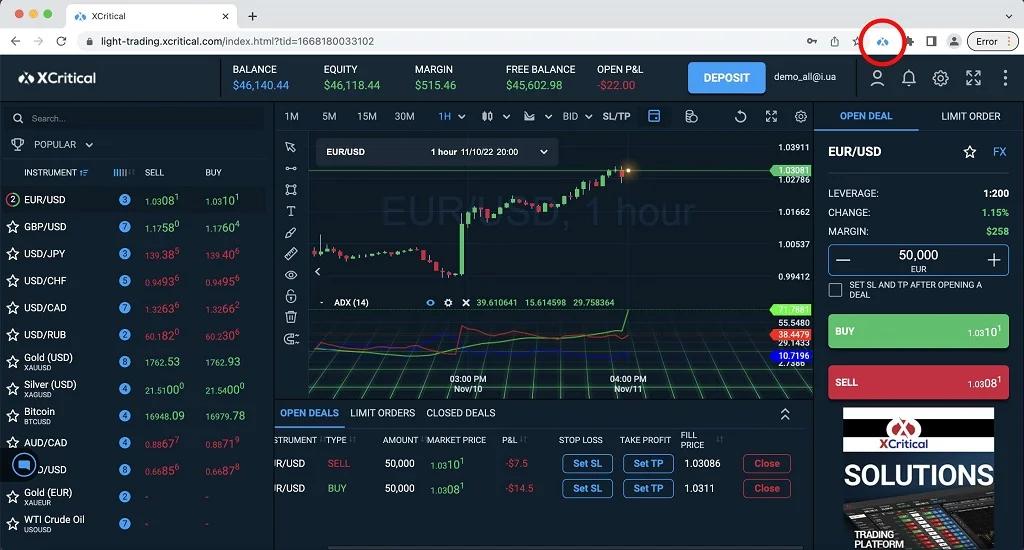

Book a day and time for a demo with one of our success managers, and we’ll show you the next generation of forex CRM systems designed with one thing in mind. These integrate directly with your Admin and Client portals and your trading platforms (MT4 and MT5) for a seamless deposit and withdrawal procedure. In addition, Yoonit works in the cloud, secured with Microsoft Azure servers and technology. Your clients manage all their account activities, such as uploading KYC documentation, opening new trading or demo accounts, deposits and withdrawals, and transferring funds between their accounts.

Such institutional market makers can bring in substantial liquidity to the market. Expert Market Making Companies – These specialist firms concentrate on market making across numerous financial tools, cryptocurrencies included. These companies commonly utilize high-tech trading algorithms and technologies to automate their market-making operations. However, the growth and popularity of cryptocurrency markets have resulted in a significant role for market makers.

Fund Your Business

HubSpot is also noteworthy, as it offers comparative functionality at no cost, so small businesses can get started without a hit to their budget. To deliver on this successfully, IG has adopted the time-honored adage, “go big or go home” because it can. Low spread costs, an emphasis on customer service and education, actionable research, and functional user interfaces make this broker well-suited to compete in the online forex broker market. When selecting your forex broker, you should consider trading platforms and tools, the number of currency pairs offered, customer service and, of course, trading costs.

Given the intricacies of the Forex industry, a system specifically tailored to cater to the complexities and regulatory requirements of this unique market is required. Therefore, it’s recommended to set feasible objectives and hopes and locate a trustworthy liquidity provider within your budget range. Trading volume is an important factor that many new traders or investors heavily rely on. Experienced investors are aware of the mutual dependence between an asset’s price and its trading volumes. Bitcoin, for example, is one of the most liquid cryptocurrencies with a daily trading volume of $21.37 billion. As a Gold Microsoft Partner, we know how to deploy secure systems, so if you need to integrate a custom service, we’re more than happy to move forward with that.

Company size

But not all CRM systems are equal – and choosing the right provider isn’t always easy. So, we’ve analyzed and tested some the best CRM for small businesses to help you find the right fit. Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. The answer to this question will depend on the type of business you want to start and where you’re located. Some businesses, such as restaurants, will require a special permit or license to operate.

In a nutshell, we present you with a robust system to track your clients’ activities effectively, from registration and email confirmation to engagement levels and trading behaviors. An invaluable feature of the Admin Back Office is its capability to administer bonuses. Whether you choose to credit bonuses to user balance or credit, it is all up to you. As an admin, you also have the power to permit your managers to provide clients with personal bonuses, fortifying the relationship between your sales team and clients. We have long-standing experience in the financial services market, and hence we truly understand that in Forex trading, every moment is precious. We therefore put quality and speed on equal footing, assuring that you save time while also guaranteeing high-quality service.

Get Listed in Online Directories

Liquidity package offered by your liquidity provider has a direct impact on your brokerage firm’s financial success and credibility. For companies where a sizable percentage of payments is done in cryptocurrency, our Forex CRM system is now capable of performing automatic cryptocurrency account replenishment with unrivaled convenience. Our Forex CRM system ensures effortless account management for all our traders. They have the convenience of browsing through the available account types, setting up the best match according to their needs, and customising account leverage and execution type from the list approved by us.

Our research found that Zoho CRM is the best CRM for small businesses, offering access to a wide range of advanced features on its low-cost plans, making it an accessible option for teams with a smaller budget. Plus, it offers a free forever plan, which can get you started before you make a financial commitment. One downside for American traders is that many top forex brokers are based in the U.K. Below are some top forex brokers, including one that allows customers to trade cryptocurrencies.

CMC Markets: Best Overall and Best for Range of Offerings

The company went public in 2007, listing on the Warsaw Stock Exchange under the ticker symbol XTB, and it was rebranded as XTB Online Trading (XTB) in 2009. The best business structure for your business will depend entirely on what kind of company you form, your industry and what you want to accomplish. But any successful business structure will be one that will help your company set realistic goals and follow through on set tasks. Customers use online directories like Yelp, Google My Business and Facebook to find local businesses. You can also create listings for your business on specific directories that focus on your industry. Consider how much money is needed, how long it will take before the company can repay it and how risk-tolerant you are.

- Good CRM allows you to see all your clients and their trading activity, control deposits and withdrawals, monitor KYC procedures, and execute your marketing activities.

- While it is difficult to be certain about the future of crypto in general and therefore crypto liquidity given its tumultuous history.

- Sales SupportMaking it easy for sales agents and IBs to generate and nurture leads is a central part of any CRM.

- It is essentially a system that helps streamline processes, build customer relationships, increase sales, improve customer service, and increase profitability.

- Needless to say, even the best product will lose out to competitors if it has weak customer support.

ECN increases the transparency in your transactions as it displays the best bid and offer prices available in the market, with immediate trade execution. This allows you as a broker to provide a fair and transparent trading environment for your clients, where trades are executed instantly and at the most competitive prices. Moreover, by displaying depth of market data, ECN can empower your clients to make informed decisions.

This article will delve into these aspects in detail, providing you with a comprehensive guide on what to look for when selecting a forex CRM. Stay tuned as we explore these features, and more, ensuring you make an informed decision that will positively impact your brokerage’s productivity and profitability. Discover the power of Forex CRM to boost client satisfaction, drive business growth, and stay ahead in the competitive financial industry. Explore the advantages of centralized client management and unlock new opportunities for success.

Myth 1. CRM systems are useless for small brokerage companies.

At Broker Solutions, we understand the unique challenges faced by brokerage houses. With years of experience in the industry, we are proud to provide our clients with custom CRM solutions tailored to suit their individual needs. Our solution enables brokerages to effectively manage client information Cryptocurrency Pockets Development Companies and transactions, ensuring accuracy and efficiency in their operations. It can not only help you manage and grow your business but also assess customer satisfaction and loyalty. With this in mind, consider researching different CRM solutions to see which one fits your needs and budget.