Contents

This type of candlestick represents a price increase over the period in question. The default color of a bullish Japanese candlestick is green, although white is also often used. The most bullish candlestick patterns are the hammer, the inverted hammer, the cloud break, three white soldiers.

These are called “hammers” because the wick looks like the handle and the body looks like the head of the hammer. Hammers indicate a possible reversal in a downtrend, especially when seen next to at least 1 week of candlesticks that show the market going down. Candlesticks with long upper shadows and short lower shadows show that buyers drove up prices during trading but sellers forced them down by closing time. This helps you understand the activity that influenced trading of the market.

- Hammers indicate a possible reversal in a downtrend, especially when seen next to at least 1 week of candlesticks that show the market going down.

- A hammer at the low of a downside momentum signals a bearish trend reversal up, suggesting the price should be rising.

- Eventually, with time and experience, you can quickly analyse market conditions and make a trading decision through technical analysis.

- An example is Moving Averages, whose slope and direction reflect the trend direction as well as its momentum.

- A harami cross is a candlestick pattern that consists of a large candlestick followed by a doji.

It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. On both red and green sticks, the upper and lower wick always represent the same thing. Candlestick chart reading can be most useful during these volatile periods of irrational market behavior. Once you have mastered the identification of simple Candlestick patterns, you can move on to trading more complex Candlestick patterns like the Bullish and Bearish 3-Method Formations. However, following the price rally, an evening doji star appears, signaling a downward reversal.

A simple candlestick pattern requires a single candlestick, while the more complex candlestick patterns usually require two or more candlesticks to form. The candle body, also known as the real body, is the long rectangular box. The bottom of the body tells you the opening price and the top of the body tells you the closing price. You may see a thin line extending from the top or bottom of the body. The purpose of a reversal candlestick pattern is to give a signal that the short-term direction of the market, over the next several periods is changing.

Open an account today

There is usually a significant gap down between the first candlestick’s closing price, and the green candlestick’s opening. It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. If you see a spinning top candlestick with shadows of equal lengths after a long incline or decline period for a market, it can sometimes represent a reversal in the trend.

On the chart, you will see how various currencies move and you can ascertain the tendency of going up or down at a particular time. It has to do with the two axes and the y-axis is on the vertical side, and it stands for the price scale while the time is depicted on the horizontal side which is thex-axis. Finding the right combination is different for every trader, so it’s important to start with the basics before you start working your way into using technical indicators . Candlesticks are good at identifying market turning points – trend reversals from an uptrend to a downtrend or a downtrend to an uptrend. The bottom of the vertical bar indicates the lowest traded price for that time period, while the top of the bar indicates the highest price paid. With a chart, it is easy to identify and analyze a currency pair’s movements, patterns, and tendencies.

Bearish Engulfing Pattern

The pattern completes when the fifth day makes another large downward move. It shows that sellers are back in control and that the price could head lower. The bullish harami is the opposite of the upside down bearish harami. A downtrend is in play, and a small real body occurs inside the large real body of the previous day. If it is followed by another up day, more upside could be forthcoming.

This situation could bring about a market reversal, which is a price move contrary to the preceding trend. By now, you should have a good idea about what a Candlestick is and how to read simple and complex Candlestick patterns. So, let us now try to read trading charts to see how we can trade using these patterns.

A Must-ReadeBook for Traders

The last candle closes deep into the real body of the candle two days prior. The pattern shows a stalling of the buyers and then the sellers taking control. The smaller the real body of the candle is, the less importance is given to its color whether it is bullish or bearish. Notice how the marubozu is represented by a long body candlestick that doesn’t contain any shadows. Candlestick patterns are useful for spotting areas of support and resistance. They are also valuable for confirming your predictions about market movements.

Whenever making trading decisions based on technical analysis, it’s usually a good idea to look for confirming indications from multiple sources. As you can see, the candle might look the same but the previous trend and its direction give different signals. Notice that each candle pattern in the hammer family is a reversal pattern that could be bearish or bullish depending on what directional move preceded it. Candles are constructed from 4 prices, specifically the open, high, low and close. They also form different shapes and combinations commonly known as candlestick or candle patterns. Candle patterns can be single, double or triple patterns that consist of one, two or three candles respectively.

You see, most large banks and hedge funds also watch key market levels and price action around critical levels. Once the Engulfing Bullish Candlestick formed around this crucial support level, it prompted a significant number of pending buy orders just above the high of this Engulfing Bullish Candlestick. Once the price penetrated above the high, it triggered those orders, which added the additional bullish momentum in the market.

There are several blocks you will find in the middle which shows the opening and https://business-oppurtunities.com/ price ranges. In the trading world of Forex, you must learn the charts first before you can begin trades. It is the basis on which most exchange rates and analysis forecasting is done and that is why it is a trader’s most important tool. On the Forex chart, you will see the differences in currencies and their exchange rates and how the current price alters with time. These prices range from GBP/JPY to EUR/USD and other currency pairs you can view.

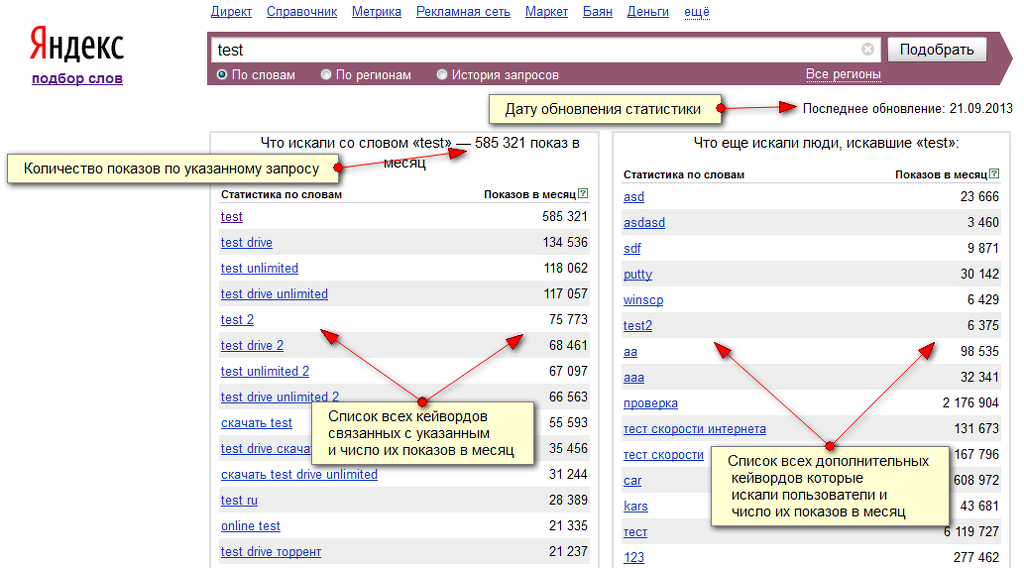

To accurately analyze whether it is needed to choose a broker maximarkets graphs, one should study most common candlestick patterns and practice in a price chart. For a beginner, it will be enough to learn most common trend continuation and reversal patterns. I also gave examples of candlestick analysis in the real price charts, described how to define candlestick patterns and trade them in real trading. A bearish engulfing pattern develops in an uptrend when sellers outnumber buyers. This action is reflected by a long red real body engulfing a small green real body.

However, it is worth mentioning that there is a lot that candlesticks cannot tell you. For instance, you cannot use them to learn why the open and close are similar or different. A candlestick pattern might seem perfectly formed on one timeframe but it can also appear completely opposite on another. This makes it difficult to trust the message of a candlestick pattern a 100 percent, if you use multiple timeframes. Therefore it can cause doubt for traders to decide and execute their trades.

The 4HWalt Disney Co. stock chart displays a series of the evening star patterns, following which the price starts to decline. Further confirmation of a soon downtrend is a series of the hanging man patterns. A bearish harami cross more accurately predicts the top of an uptrend than a bullish harami cross signal the bottom of a downtrend. A bearish harami consists of a long bullish candlestick, followed by a small bearish candle. The body of the second candlestick should be red or black, and the shadow of the candle may not be engulfed.

The pattern will have a long upper wick, a small or no lower wick and a small real body that is near the low of the day. A bullish harami is usually indicated by a white candle showing a small increase in price, that is contained in the downward price movement from the past few days. The bullish harami is a chart indicator that can signal the reversal in a bear price movement. Traders can take this as a good sign to enter into a long position of an instrument.

Forex Candlestick Patterns: A Basic Guide for Forex Traders

This candlestick pattern generally indicates that confidence in the current trend has eroded and that bears are taking control. The classic pattern is formed by three candles although there are some variations as we will see in the Practice Chapter. The upper and lower shadows on candlesticks can give information about the trading session. Upper shadows represent the session high and lower shadows the session low.